Leasing Versus Buying A Car

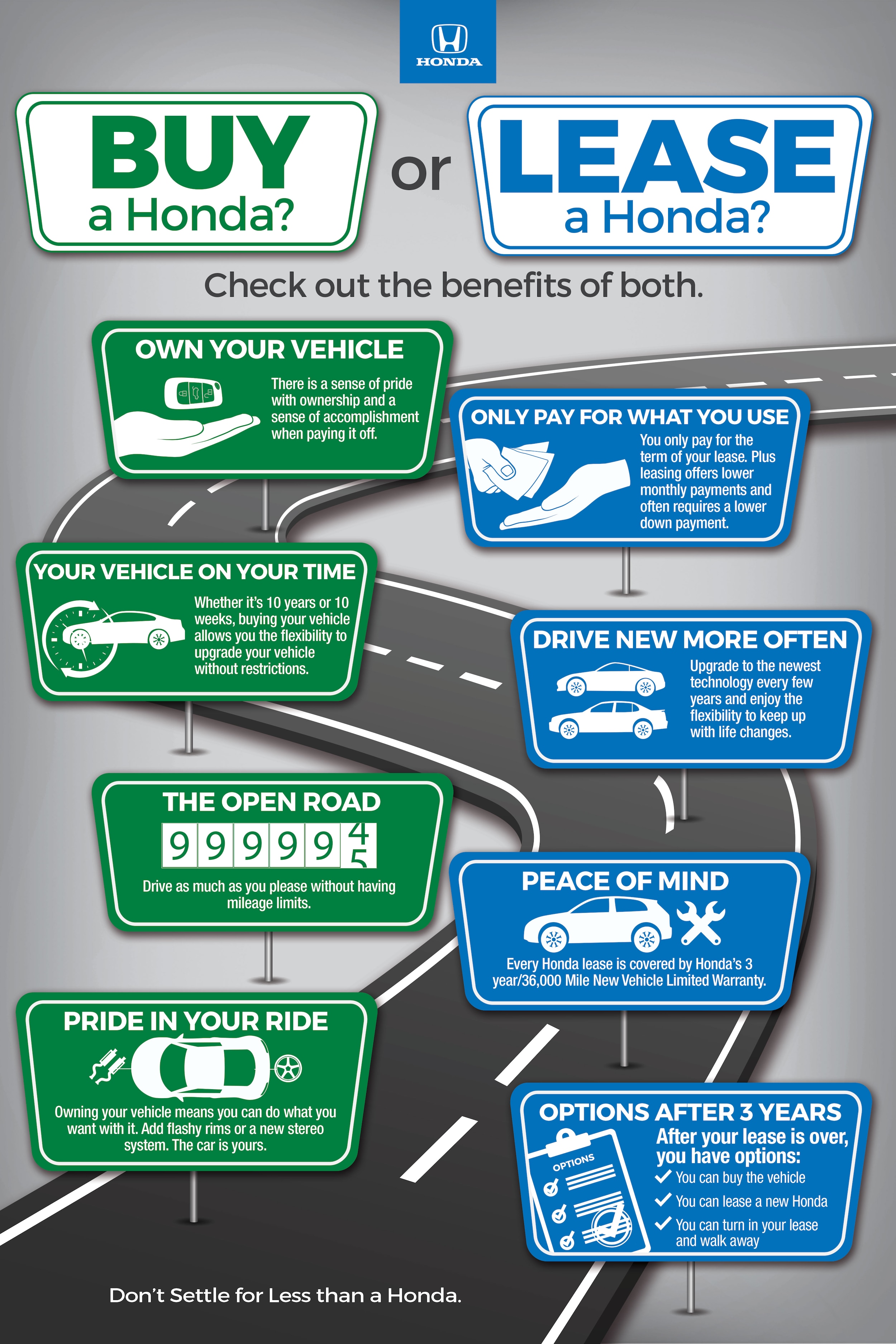

It offers the opportunity to switch vehicles relatively often.

Leasing versus buying a car. Car buyers have two financing options when it comes time to purchase a new car. But leasing has very strict limits. Consumer reports examines the basic differences. Instead youre merely charged for using the car during your lease contract.

Purchasing a car allows you to drive as far as you want. Leasing does not. Did you know you are always covered by a warranty when leasing a car and not when you buy. Ultimately you can say good things about both buying and leasing.

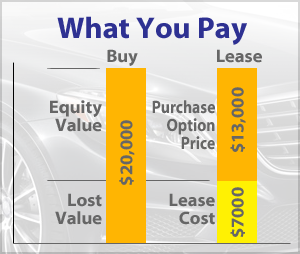

A chunk of each payment is. If the car sells for 30000 youll need to take out a loan for 30000. For some drivers leasing or buying is purely a matter of dollars and cents. Their prices can be out of reach for many shoppers.

Leasing is a good choice if you tend to get bored with your ride or if you love that new car smell. Youd enjoy a few years without a car payment which is the point of car buying. Fortunately car leasing allows consumers to get behind the wheel of a new vehicle with a monthly payment thats usually lower than it would be if you purchased it. If you buy a car outright and you dont have the cash to pay for it you take out a loan.

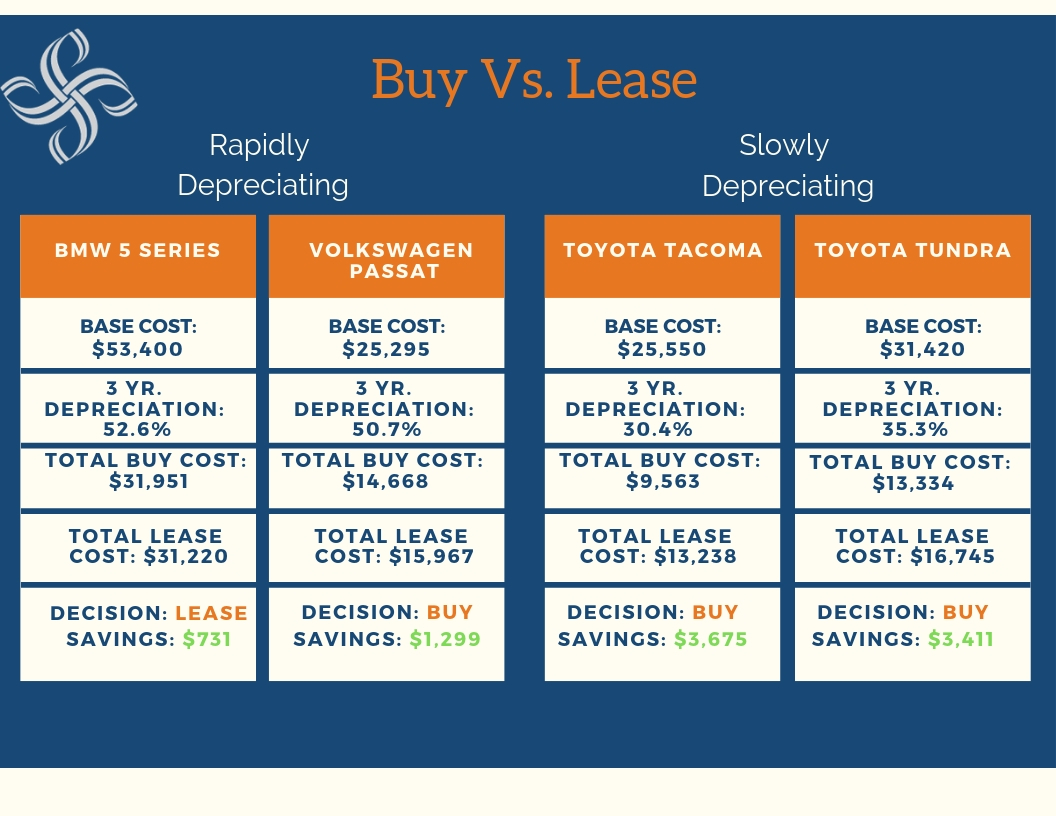

You borrow money from a lending institution and make monthly payments for some number of years. 9 advantages to leasing a car for most people buying a car usually makes more financial sense than leasing however if a lease turns out to be right for you then you should be aware of the advantages it offers versus buying a car. Buying a vehicle with a conventional car loan is pretty straightforward. Review more pros and cons of leasing vs.

Lets assume no down payment. For others its more about forming an emotional connection to the car. Even with long term auto loans it can be tough to afford a new car. If you go over the mileage limit and decide to turn in the lease as opposed to purchase the vehicle you could be on the hook for thousands of dollars in fees.

Thats something people often forget.