Iowa Car Registration

However you may be able to renew your vehicle registration online or by mail by contacting your county treasurers office.

Iowa car registration. Insurance is not a requirement during registration but is a necessity if you drive on state roads and highways. Bring your vehicle title drivers license an odometer statement a damage disclosure statement if applicable and payment for your required fee. You can also find your registration renewal fees on your renewal notice. All vehicles must be registered to legally be driven in iowa.

For small plates the tags should be affixed to the upper left corner. Registration renewal fees in iowa vary by county. It is recommended that. All vehicle registrations are completed at an iowa treasurers or approved location.

Contact your local iowa dmv office or check your county treasurers website. Vehicle registration in iowa must be done in person at your local treasurers office. Iowa law requires you to register your motor vehicle with the county treasurers office in your county within 30 days from the date you establish residency. While some registrations pay standardized fees others have weight and price based fees.

Registering your car in iowa. Weve outlined the iowa car registration process keeping it as easy as possible. Find out more information. However prior to applying for a custom car registration with the dot motor vehicle division mvd vehicle owners must ensure that their vehicle qualifies for this type of registration document.

Jarret heil marshall county treasurer motor vehicle department courthouse 1 e main st marshalltown iowa 50158. Registering a motor vehicle in iowa looking for interstate registration for commercial vehicles. Law enforcement defines the enforcement date as the first day of the second month following the registration month. Fees to renew your ia vehicle registration.

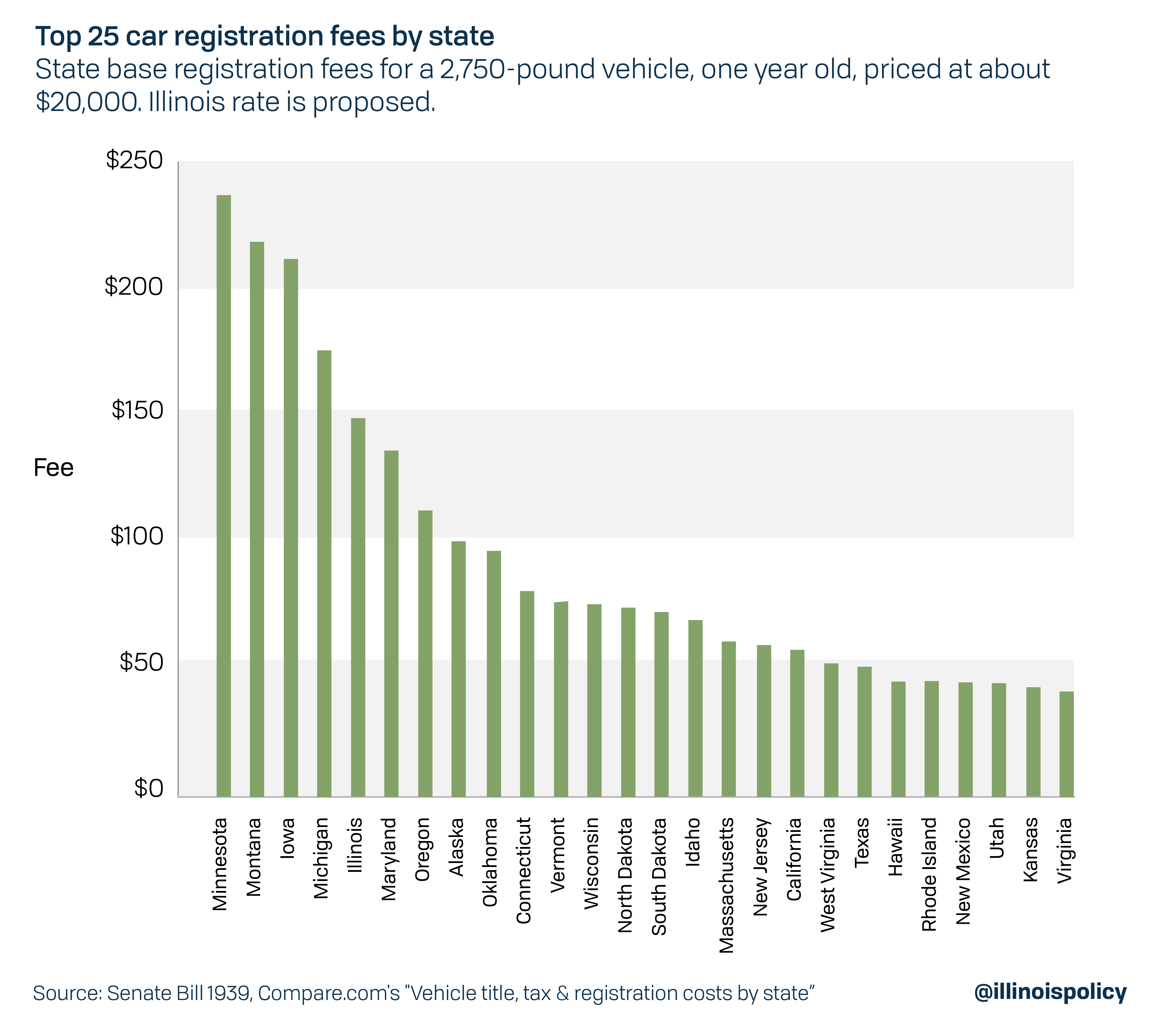

How to register your vehicle in iowa. A summary of registration fees by vehicle type has been provided below. The annual registration fees are determined by iowa code sections 321109 and 321115 through 321124 and are to be paid to the county treasurers office in the county of residence.