Credit Score For Car Loan

Other considerations include length of credit history credit lines recently opened and ones credit mix credit cards retail accounts student loan installment loans etc.

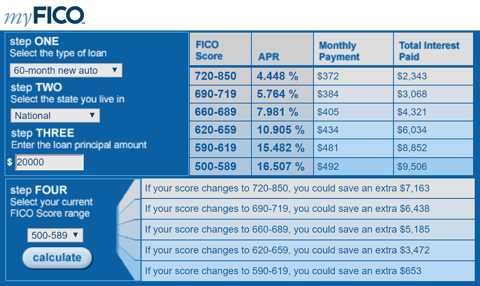

Credit score for car loan. Heres what you need to know about how your credit score affects a car loan what credit score you need to get approved and other things to consider before applying. The average auto loan interest rate for people with an excellent credit score of 750 or higher is 498 for a new car and 523 for a used car. Good credit 700 749 people with good credit scores of 700 749 average an interest rate of 507 for a new car and 532 for a used car. Your lender or insurer may use a different fico score than fico score 8 or another type of credit score altogether.

The information contained in ask experian is for educational purposes only and is not legal advice. While you may be able to get approved with lower scores the pool of possible lenders will be smaller than if your scores were higher. Its possible to get approved for an auto loan with just about any credit score but the better your credit history the bigger your chances of getting approved with favorable terms. Earlier we mentioned that a score of 630 is generally the minimum for getting approved with few issues but considering the fact we said that higher scores mean lower rates it would be better if your score is.

The average credit scores for a new auto loan were 717 while the average scores for used car financing were 661. Opinions expressed here are authors alone not those of any bank credit card issuer. In addition to the fico score a credit report will disclose all open and closed credit sources credit inquiriesapplications made and information on overdue debt bankruptcies and civil lawsuits.

Insight/2020/04.2020/04.21.2020_Subprime%20Auto%20Repromotion/Auto%20Loan%20Originations%20by%20Credit%20Score.png?width=911&name=Auto%20Loan%20Originations%20by%20Credit%20Score.png)