Average Car Payment Interest Rate

Car loan interest rate.

Average car payment interest rate. Actually if were being real here leasing companies will actually never tell you the real value of your interest rate. On average americans take out about 51 billion in 23 million new auto loans each month. Typically the annual percentage rate apr for auto loans ranges from 3 to 10. The average monthly car payment in the us.

Americans borrow an average 32480 for new vehicles and 20446 for used. The national average for us auto loan interest rates is 527 on 60 month loans. What is the average interest rate for new and used cars. Finding the perfect car takes time research and sometimes a little.

What does the average car loan look like. Most people buying a car spend hours searching for the perfect vehicle. Is 550 for new vehicles 393 for used and 452 for leased. A sizeable down payment signals to lenders that you are serious about this investment and may lead to a more desirable interest rate.

Although the average car payment is significantly lower for used cars the average interest rate is much higher at 903 compared with 573. Instead they disclose the money factor of your lease which is essentially a. Auto debt makes up 95 of american consumer debt. Thats partly because new car loans have some of.

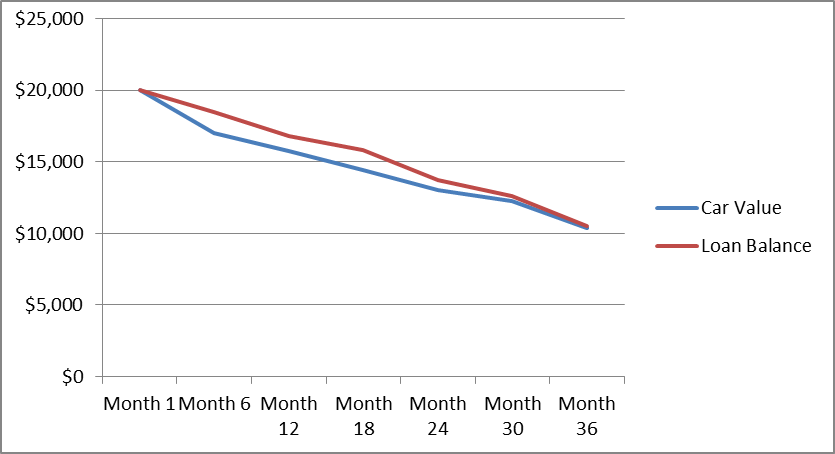

Your loans interest rate influences how much youre going to pay for month to month. People with good credit will pay a similar amount. When buying a new or used car your interest rate can have a big effect on your monthly payment. Its a percentage of the loan amount that accrues over the life of the loan.

For individual consumers however rates vary based on credit score term length of the loan age of the car being financed and other factors relevant to a lenders risk in offering a loan. Your auto loan interest rate will have a big impact on your monthly car payment. Color trim and horsepower are all amenities we might obsess over. Car loan interest rates change frequently so its important to keep track of them.

March 25 2019 auto. A larger loan especially if you have a high debt to income ratio will likely come with a steep interest rate while a small loan will likely come with favorable terms. When the rate jumps to. The average monthly car payment on a new vehicle in 2018 was a hefty 545.

Thats exactly right car lease contracts arent required to state the monthly payment adjusted with the interest rate youre being charged so a lot of the time it wont show up. The average rate for a new car in mid 2019 was 627 while the average rate for a used car was 1007. Overall americans owe more than 12 trillion in auto loan debt. And a lower interest.