Car Lease Tax Deduction

To use the standard mileage rate you must own or lease the car and.

Car lease tax deduction. If you lease a car for your business dont miss out on your deductions. Your personal income tax and your self employment tax the amount you pay into social security and medicare as the owner of your rideshare business. Sometimes the person assuming your lease takes on total responsibility for the duration of the contract while in other cases youre still on the hook for lease payments if they fail to pay them. With car leasing the residual value at the end of the lease can lower the lease cost and if you get a closed lease you can walk away without penalty.

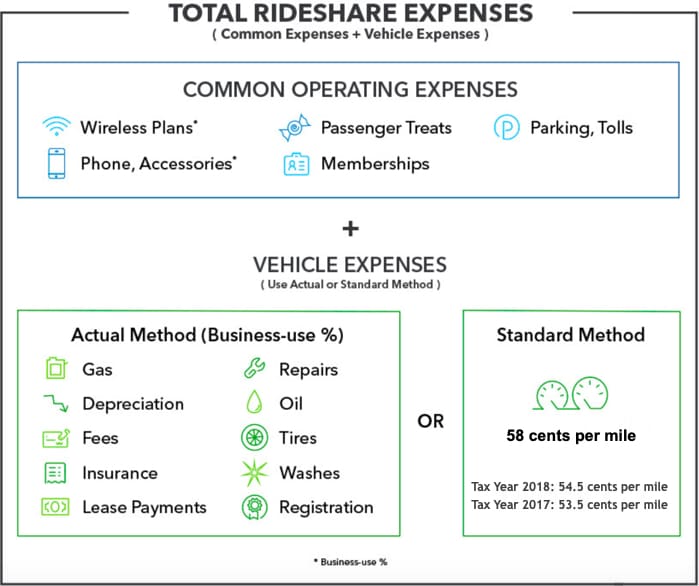

If you lease a car that you use in your business you can deduct your car expenses using the standard mileage rate or the actual expense method. This can happen if the car is in an accident for example. Claiming a car lease tax deduction. Because your business income is used to calculate two taxes.

Can i claim tax deductions for my car lease payments. You can either deduct or you claim your state income tax. 510 business use of car. Buying a car means a loan for a specific amount which you will have to pay back even if the value of the car goes below the amount of the loan.

If you pay sales tax on your car lease you may be able to take a deduction for it on your federal income taxes. Figuring out the tax you have to pay when you lease a new car can be complicated. This is a big big deal. 510 business use of car topic no.

As a matter of fact you can deduct sales tax on your leased vehicle. If you lease a new car for use in your business you will probably be able to deduct the lease payments from your taxes as a business deduction. Deducting sales tax is only possible from your states or local sales tax. If you use the standard mileage rate you get to deduct 575 cents for every business.

The business use of your car can be one of the largest tax deduction you can take to reduce your business income. If you use actual expenses to figure your deduction for a car you lease there are rules that affect the amount of your lease payments you can deduct. How to deduct lease payments. If you pay tax at the higher rate that will mean you pay tax at 40 percent on benefits you receive.

If you claim the standard deduction then you cannot deduct sales taxes. Because the amount can be substantial it is. In most states with a state income tax it would realistically be. For the definition of car for depreciation purposes see car defined under actual car expenses later.

Lets go over how you can take a car lease tax deduction. You must not operate five or more cars at the same time as in a fleet operation you must not have claimed a depreciation deduction for the car using any method other than straight line you must not have claimed a section. See leasing a car later. In this publication car includes a van pickup or panel truck.

Deducting sales tax on a car lease. If co2 emissions of your company car are below 130gkm you can claim corporation tax benefits that enable you to offset all of your rentals against your company profits. In december 2017 congress passed tax reform legislation that.