Average Apr For Car

The average apr for all cards in the us.

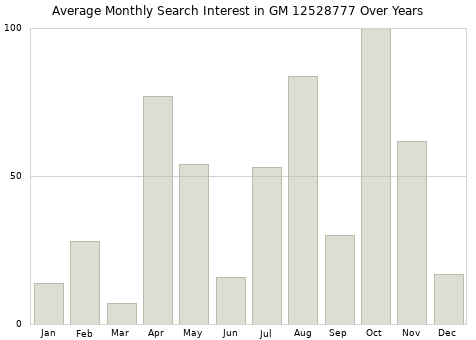

Average apr for car. Often a credit union can offer better aprs than a. News database is 1553 to 2268. The typical auto loan drawn for a used car is substantially less than for a new model with consumers borrowing an average of 20446 for used cars and 32480 for new. Most times you will end up between 4 and 7 for average aprs.

Use this chart to compare credit card apr offers with the average minimum and maximum apr of credit cards in the us. The average apr for a car loan for a new car for someone with excellent credit is 496 percent. Visit howstuffworks to find the average apr for a car loan. Depends on your situation and the model car and dealer you are buying from.

And these statistics dont tell the whole story. Below is the average apr for new and used vehicles based on each credit score range and a 20 trade in or down payment. So theres certainly a wide range of apr for car loans and its important to know where youll fit before starting the car buying process. The average apr for a car loan for a new car for someone with bad credit is 1821 percent.

Scores range from 300 to 850 and your rate will be slightly higher if youre purchasing a new car versus a used car. However terms longer than 48 or 60 months are generally not allowed for older model used cars as the potential risk for car failure grows with age. The average apr may also vary depending on the. If you know the average apr for the type of credit card youre considering you can recognize a good offer when you see it.

So theres certainly a wide range of apr for car loans and its important to know where youll fit. In fact the national average apr of all the credit cards where interest was assessed is even higher at 1661. The average apr for a borrower with good credit a score between 661 and 780 was 496 for a new car purchase and 636 for a used car purchase according to experian data from 2019. The average apr for a car loan for a new car for someone with bad credit is 1821 percent.

A score in the 500s could lead to a 1705 percent apr. The average credit card apr isnt necessarily reflective of the apr youll receive on a credit card youre approved for though.